In the fast-paced world of finance, understanding and managing risk is essential for success. At Bloom Analytics, we employ advanced technologies to navigate the complexities of risk analytics, particularly in the context of embedded lending. Today, let’s explore how machine learning (ML) serves as a linchpin in our endeavors, driving precision and innovation in identifying borrowers across the credit spectrum. Additionally, we’ll differentiate ML from generative artificial intelligence (AI) to better understand their respective roles in shaping the future of finance.

In embedded lending, understanding borrower profiles across the credit spectrum is paramount. ML serves as our primary tool in this endeavor. Initially, we feed our ML algorithms vast amounts of data, encompassing historical borrowing patterns and credit scores. Through meticulous analysis, these algorithms discern patterns and correlations, enabling us to identify borrowers with varying degrees of credit risk.

Moreover, unsupervised ML further enhances our understanding by revealing hidden patterns within borrower populations. By clustering similar borrowers based on shared characteristics, we gain insights into nuanced behaviors and preferences, facilitating tailored lending strategies.

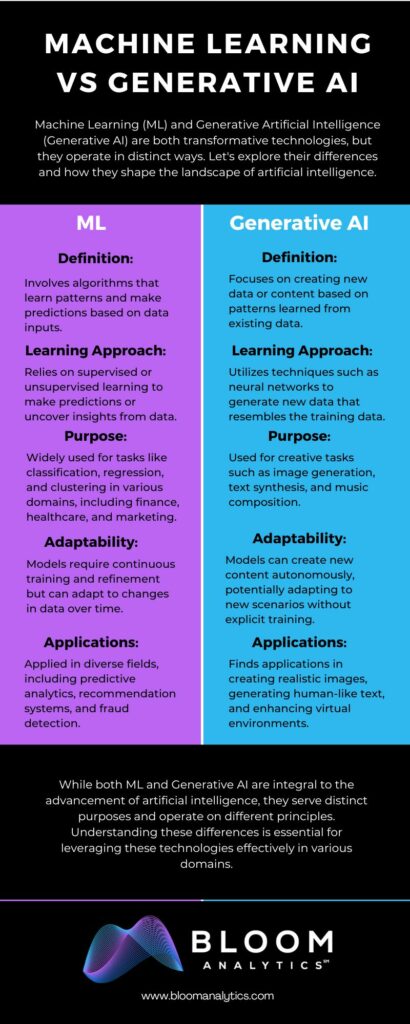

It’s important to differentiate ML from generative AI. ML operates on the principles of learning from data to make predictions and decisions. In contrast, generative AI focuses on creativity and adaptability, aiming to learn and innovate in novel situations. While ML drives our risk analytics endeavors, generative AI explores new frontiers and pushes boundaries in the AI landscape.

In conclusion, at Bloom Analytics, ML serves as the cornerstone of our risk analytics framework for embedded lending. With its precision and adaptability, ML enables us to navigate the complexities of borrower profiles and optimize lending strategies. As we continue to innovate in risk analytics, ML remains integral to our pursuit of excellence in embedded lending and beyond.

To learn more about how Bloom Analytics uses AI to optimize underwriting and risk analytics, schedule a consultation now.