UnderWrite Pro

Predict default rates. Lower bad debt. Drive growth.

Reduce risk, boost repayment rates, and drive revenue growth with customized underwriting. Our advanced underwriting solutions and team of data scientists help lenders and non-financial brands make smarter, data-driven decisions for optimal portfolio health. Each decisioning solution is customized based on your specific business model, product, and unit economics goals.

Cutting-edge software

Third-party data integration

Bloom logic and decisioning methodology

Customized machine learning models

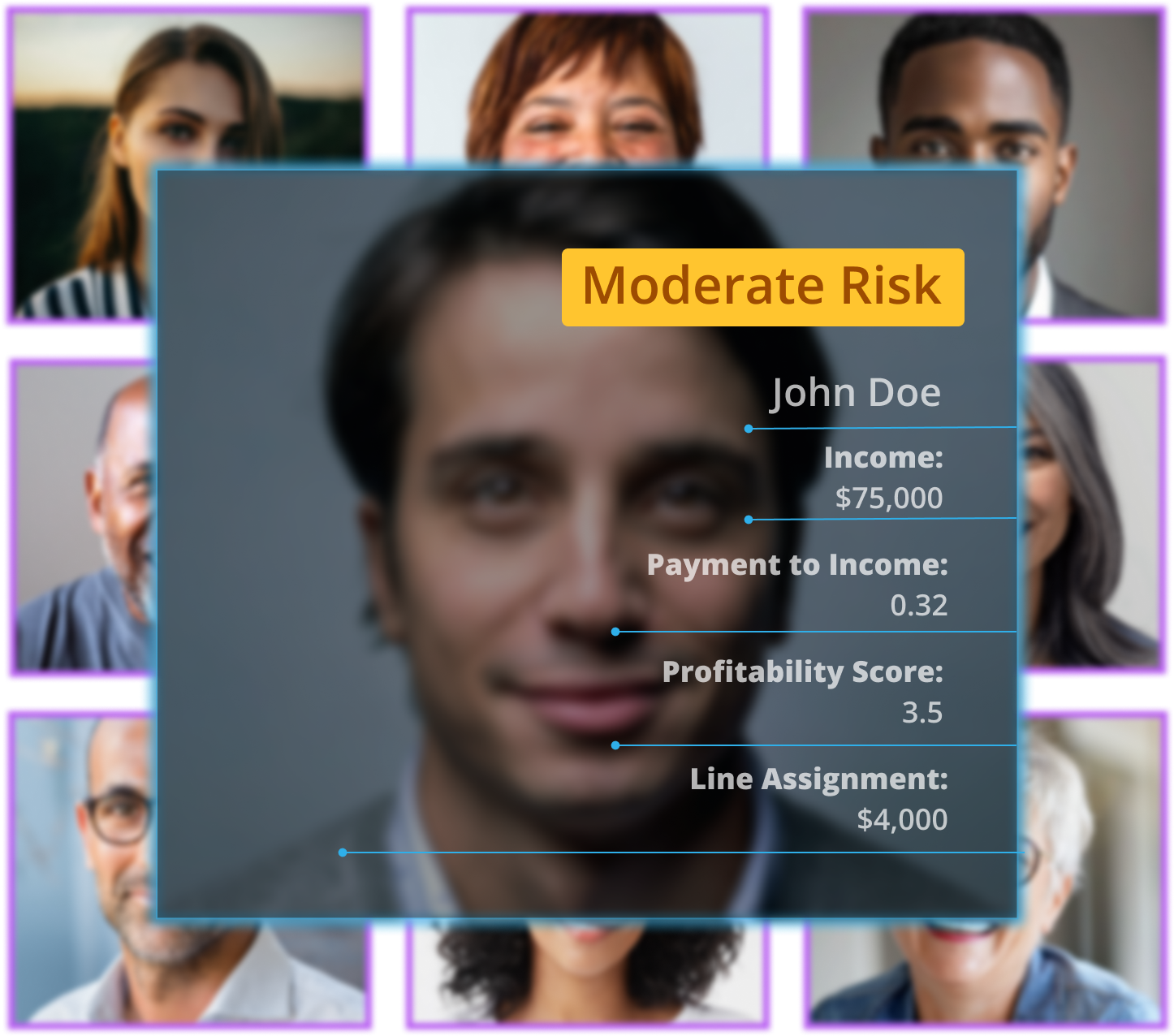

Accurately evaluate borrowers shopping for loans or customers looking for financing and payment plans.

Leverage AI-driven predictive analytics to match borrowers with tailored loan products or give your customers access to personalized financing. Reach borrowers and customers from across the credit spectrum with advanced decisioning tools.

Customizable consumer credit underwriting platform

White label solution for embedded lending platforms

A data-driven approach to personalized customer financing

Data points beyond conventional credit scores