Lenders are spending a staggering amount on data.

Figuring out which borrowers are most likely to reach payoff status isn’t a cheap process.

Between credit reports, income verification, fraud detection, and bank transaction data, underwriting costs add up fast.

Data costs can vary, depending on the loan product. Unsecured online loans, for example, require a lot more data than other loan products to gauge how applicants are likely to perform. To put things into perspective, this can look like $50 or more in data costs per originated loan.

But here’s the thing. Data is just one piece of the puzzle.

Funding loans also means balancing CAC (customer acquisition costs), operational expenses, bad debt expenses, and capital costs.

Data can be one of the biggest underwriting expenses, but the good news is: it can be optimized.

The Smarter Approach: Tiered Data & Decisioning Models

Instead of paying premium prices upfront for every single applicant, lenders can use a tiered data strategy combined with machine learning (ML) models to filter out riskier applicants early—before shelling out for expensive data sources.

While most data science teams want as much data as possible upfront, the reality is that data costs can’t be ignored. A more strategic approach considers not just how much data you can get, but when and why you use specific data points.

In many cases, starting with the least expensive data first makes sense—filtering out ineligible applicants early while keeping costs low. But it’s not the only way to optimize data spend. For example, if a single data source at $0.30 per transaction could filter out 90% of applicants, it might be worth paying more upfront to save on downstream costs.

The key is a strategic approach: using the right mix of data at each stage to balance cost efficiency and approval precision.

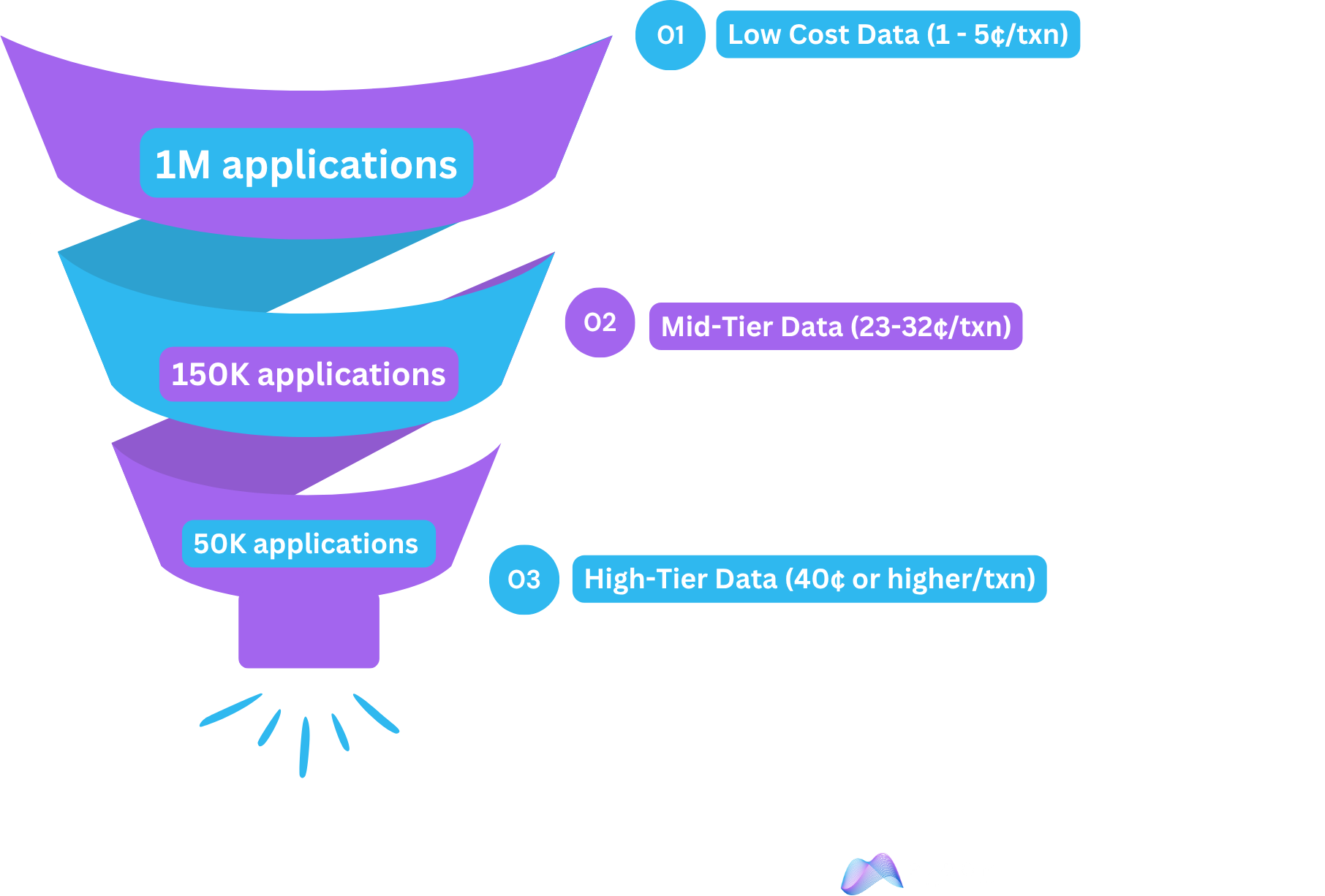

Here’s an example of how a tiered approach could work.

A Case Study in Smarter Data Spend

Let’s say you start with 1 million applicants in your pipeline. If you’re running traditional underwriting, you might be paying full price for data on every single one. That adds up.

Now, imagine a tiered approach:

Stage 1: Low-Cost Data (1-5¢ per transaction)

- Start with the most inexpensive data (like public records, phone/email verification, or basic credit flags).

- Use ML models to automatically filter out obvious declines (fraud, incomplete applications, etc.).

- Outcome Example: 85% of applicants eliminated early → 150K remain.

Stage 2: Mid-Tier Data (23-32¢ per transaction)

- Pull additional data (like identity verification, income verification, alternative credit scoring, or transaction history).

- Further refine applicants using decisioning models to score risk.

- Outcome Example: 67% filtered out → 50K remain.

Stage 3: Premium Data (40¢ or higher per transaction)

- Now, invest in high-cost sources (full credit reports, employment verification, credentialed bank data, deep fraud checks).

- Final filtering to select only the best-qualified applicants.

- Outcome Example: 40% filtered out → 30K loans funded.

What This Means for Your Bottom Line

Instead of paying premium prices for every application, you’re reserving those costs only for the best borrowers. That’s how you cut waste and improve unit economics per funded loan.

At Bloom Analytics, we’ve analyzed hundreds of millions of consumer applications, giving us deep insight into patterns in borrower behavior. These insights allow us to build highly predictive, custom models that help lenders make smarter underwriting decisions. By refining decisioning at every stage of the process, our clients can reduce data costs, improve approval precision, and strengthen their bottom line.

For lenders buying leads in the open market, our lead quality score—BloomGrade—offers a low-cost way to pre-filter applicants without relying on expensive third-party data. It delivers near-instant feedback on lead quality, helping you focus your underwriting resources where they matter most.

Ready to cut data costs without sacrificing approval quality? Bloom can help. Contact us to schedule a free consultation today.

Found this insightful? Share on LinkedIn.