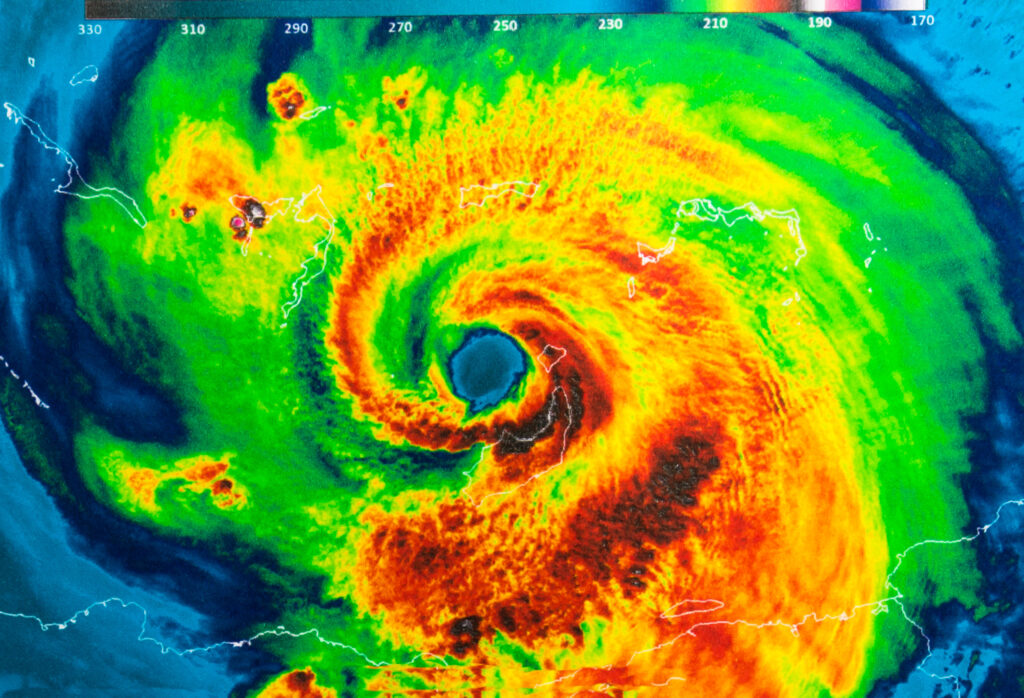

Hurricane season is here, and Beryl is coming! The first Category 5 storm of 2024 is prompting local governments to issue warnings and residents in her path to take shelter. But Beryl should be a reminder for lenders to be prepared too.

Natural disasters impact lives, and consequently, they should impact business strategy.

Here are six ways consumer lenders could prepare to maintain profitability during a natural disaster.

#1 – ZIP Codes! ZIP Codes! ZIP Codes!

As Beryl churns across the Caribbean Sea on a path toward parts of Mexico, forecasters are monitoring its potential impact on the United States’ Gulf Coast.

What does that mean for lenders with consumers in states like Texas or Louisiana?

ZIP Codes! ZIP Codes! ZIP Codes!

If those lenders were smart, they’d be paying attention to the ZIP Codes of the areas the storm is likely to hit and prepare to treat consumers with those ZIP Codes accordingly.

#2 – Offer deferrals.

It’s obvious that, during a hurricane, many people such as hourly workers or contractors will not be earning.

One way to handle consumers who were about to be affected by a storm is to offer them deferrals to mitigate the imminent financial hardship.

In a case like this, deferrals are good for both the lender and consumer because they have the potential to positively impact default rates while increasing customer loyalty. Deferrals allow borrowers to postpone payments without being marked as delinquent, giving them time to recover financially. By offering deferrals, lenders also demonstrate flexibility and support, fostering goodwill among borrowers. Satisfied customers are more likely to stay with the lender and make efforts to repay their loans.

In the long run, lenders can also save on expensive collection efforts and enhance their overall portfolio health by reducing default rates through deferrals.

#3 – Create a new product.

It’s very possible that lenders may see a spike in loan applications in the weeks following a natural disaster. People are back to work and may need help covering expenses that accumulated during the disaster.

A smart business strategy would be to create a product tailored to capture those potential new applicants. Some may not qualify for the lender’s current loan offerings under normal underwriting parameters. But to prepare for this potential spike, the lender could offer new products – smaller loan amounts for new applicants with limited credit history, for example.

#4 – Loosen underwriting and other requirements for returning customers.

Lenders could also consider loosening underwriting parameters and other requirements temporarily for returning customers impacted by a natural disaster. For example, they may opt to temporarily revisit employment or payment type requirements.

This flexibility might be offered to VIP customers who’ve already proven they can pay back their debts, while showing understanding that the way they work or get paid may have either paused or shifted during the disaster and its immediate aftermath.

Helping VIPs while they’re in a difficult situation is likely a demonstration of empathy that they won’t forget. Much like the deferral offering for existing customers, this has the potential to boost customer loyalty.

#5 – Prep the call centers.

Whether a lender partners with a call center or has an in-house team to handle customer service, it would be a good idea to have the team reach out to customers impacted by a storm or other natural disaster.

For example, in the days leading up to a hurricane, the customer service team could contact existing customers to notify them that deferrals are available. Following the disaster, the team could reach out to VIPs with special offers designed to help them recover from the hardship.

#6 – Don’t forget employees.

A “people first” approach doesn’t just apply to customers. To ensure business continuity during a natural disaster, it usually means all hands on deck for employees across varying departments – operations, customer service, HR etc. Employees represent the engine that fuels business continuity, so making sure they’re safe should be a priority.

Pre-storm, the objectives should be to check in on all employees in the storm’s path, secure physical office spaces, and create plans to ensure essential functions keep running. And post-storm, it’s important to check in once more to make sure all staff are okay before simply returning to business as usual. Providing aid to employees significantly impacted by the disaster goes a long way.

A lender that treats its employees well in their time of need is likely to see enhanced productivity and profitability – even in stormy weather. A supportive work environment typically motivates employees to work harder and treat customers better. This, in turn, leads to lower turnover rates, increased customer satisfaction, and consequently, higher profitability.

Wrapping It Up

The big takeaway here is: when it comes to hurricanes and other natural disasters, empathy is good for business. The lenders that want to “weather the storm” – all puns intended – will adapt their strategies and match products to the context of what their consumers and employees are experiencing.

Found this Insightful? Share on LinkedIn.